- シーンから探す

-

贈る相手から探す

- 雑貨

- スニーカー

- 彫刻/オブジェクト

- ポケモンカードゲーム

- サンダル

- ポスター

- 武具

- 農業

- ミュージック

- パーカー

- タレントグッズ

- プラモデル

- 本

- 水着・ビーチグッズ

- パーツ

- 女性和服、着物

- 模型/プラモデル

- パーツ

- スニーカー

- クラブ

- スニーカー

- 魚類、水生生物

- カーディガン/ボレロ

- ゲーム

- その他

- フィットネス、トレーニング

- アクセサリー

- アクセサリー

- 栃木県の家具

- 調理器具

- キャップ

- 美術品

- オートバイ

- アメリカンフットボール

- 参考書

- ミリタリー

- その他

- 美術品

- カードゲーム

- 楽器、器材

- パーカー

- ジャケット/アウター

- 店舗用品

- その他

- 工芸品

- 自転車、サイクリング

- ショルダーバッグ

- アート、エンターテインメント

- トレーナー/スウェット

- オートバイ

- カメラ

- ウェア

- カテゴリから探す

- おまとめ注文・法人のお客様

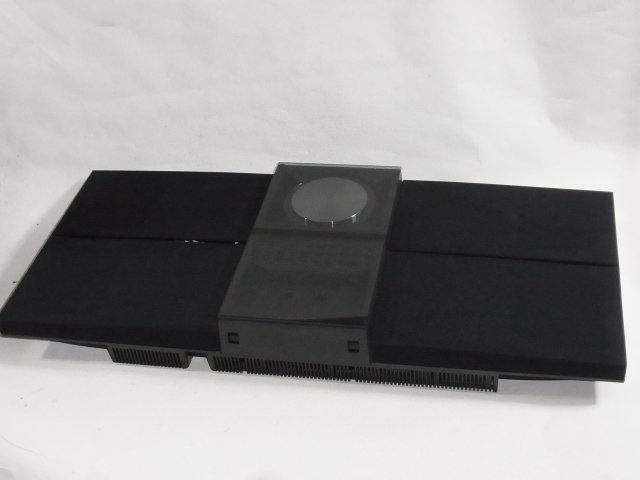

ベスト CB400SF nc42 LCIスリップオンマフラー

-

商品説明・詳細

-

送料・お届け

商品情報

CB400SF nc42 LCIマフラーになります。大きな目立った傷はありません。接続部分に液体ガスケットを塗っています。状態などは写真でご確認ください。ご理解いただける方よろしくお願い致します。商品の情報カテゴリー : 自動車・オートバイ > オートバイパーツ > マフラー商品の状態 : やや傷や汚れあり発送元の地域 : 兵庫県

残り 8 点 20,800円

(210 ポイント還元!)

翌日お届け可(営業日のみ) ※一部地域を除く

お届け日: 12月08日〜指定可 (明日16:00のご注文まで)

-

ラッピング

対応決済方法

- クレジットカード

-

- コンビニ前払い決済

-

- 代金引換

- 商品到着と引き換えにお支払いいただけます。 (送料を含む合計金額が¥291,028 まで対応可能)

- ペイジー前払い決済(ATM/ネットバンキング)

-

以下の金融機関のATM/ネットバンクからお支払い頂けます

みずほ銀行 、 三菱UFJ銀行 、 三井住友銀行

りそな銀行 、ゆうちょ銀行、各地方銀行 - Amazon Pay(Amazonアカウントでお支払い)

-